The other Wells Fargo savings account is Platinum Savings. This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period. Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts. Wells Fargo's Way2Save savings account has a $25 initial deposit requirement and has a $5 monthly service fee. The fee can be avoided by maintaining a $300 daily balance.

You can also avoid the fee by setting up a monthly transfer to your savings or enrolling in a program that moves a $1 from your checking to your savings each time you pay a bill or swipe your debit card. The account has an APY much lower than the national average. Other software companies realized that there was potential to become the platform of choice for customers to do their banking. Prodigy, owned by Sears, offered a secure network that Wells Fargo and other banks and businesses allowed to access their own company computer systems. Customers using the Prodigy service were able to access their bank accounts from the comfort of home for the first time. They could also transfer money, read news, play games, and even order groceries online using the community bulletin feature.

Customers had to buy a software package and pay a monthly fee for their software's subscription in addition to any fees charged by their bank. Customers had to use floppy disks and dial up modems to connect to their information. Wells Fargo started offering online account access through Prodigy in 1989, and by the mid-1990s it found that only about 10,000 of its 3.5 million customers used the service. A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services. Customers inquiring about their checking account balance may be pitched mortgage deals and mortgage holders may be pitched credit card offers in an attempt to increase the customer's profitability to the bank. Other banks have attempted to emulate Wells Fargo's cross-selling practices .

Founded in 1852 as a bank and express delivery company, Wells Fargo offers a full range of banking services, including checking accounts, savings accounts, CDs, money market accounts, mortgages and other loans. Federal law permits limiting certain types of withdrawals and transfers from savings and money market accounts to a combined total of 6 per statement cycle. Capital One also has a 360 Performance Savings Account that boasts a 0.4% APY.

These rates are far higher than what you can earn with any Wells Fargo product, at any balance. If you're willing to give up banking in person, Capital One's bank accounts may present better value than Wells Fargo. In September 2016, Wells Fargo was issued a combined total of $185 million in fines for opening over 1.5 million checking and savings accounts and 500,000 credit cards on behalf of customers without their consent.

The scandal was caused by an incentive-compensation program for employees to create new accounts. It led to the firing of nearly 5,300 employees and $5 million being set aside for customer refunds on fees for accounts the customers never wanted. Carrie Tolstedt, who headed the department, retired in July 2016 and received $124.6 million in stock, options, and restricted Wells Fargo shares as a retirement package. Community banking net income was $7.4 billion in 2019 on total annual revenue of $85 billion.

1$10.00 monthly service charge for Any Deposit Checking and 1% for the Planet Checking waived with one deposit of any amount each statement cycle. Deposits include direct deposit, mobile deposit, ATM deposit, or in-branch deposit of any amount. Does not include fund transfers between Bank of the West accounts or any credits from Bank of the West. No monthly service charge if any account owner is under 25 years of age. Banking, credit card, automobile loans, mortgage and home equity products are provided by Bank of America, N.A.

And affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation. Programs, rates, terms and conditions are subject to change without notice. This part of the bank's operations services retail and small business clients with their everyday banking needs. Some of the services include checking and savings accounts, loans, mortgages.

The bank serves these clients in its branches and by way of its automated teller machines . The interest rates at Wells Fargo aren't anything special, but if you're already taking out a loan or using a Wells Fargo checking account, it won't hurt to have a savings account there as well. With the more basic Way2Save Savings Account and Opportunity Savings, either a $300 daily balance or a $25 automatic transfer from your Wells Fargo checking account will waive the $5 maintenance fee.

The real cost of keeping your savings with Wells Fargo is that you'll miss out on stronger rates elsewhere. Wells Fargo offers several other products and services outside of its personal deposit accounts. The bank offers many credit cards, including several popular rewards and cash back credit cards. So that account is being treated as a money market account, since typical savings accounts lack that feature.

However, you can find higher yields elsewhere and you will pay a $12 monthly fee unless you keep a balance of $3,500 or more in the account. If you take the time to waive the paper statement fees by switching to online statements, Wells Fargo's monthly fees are slightly better than those at other major banks. However, the real advantage at this bank comes with the large variety of options.

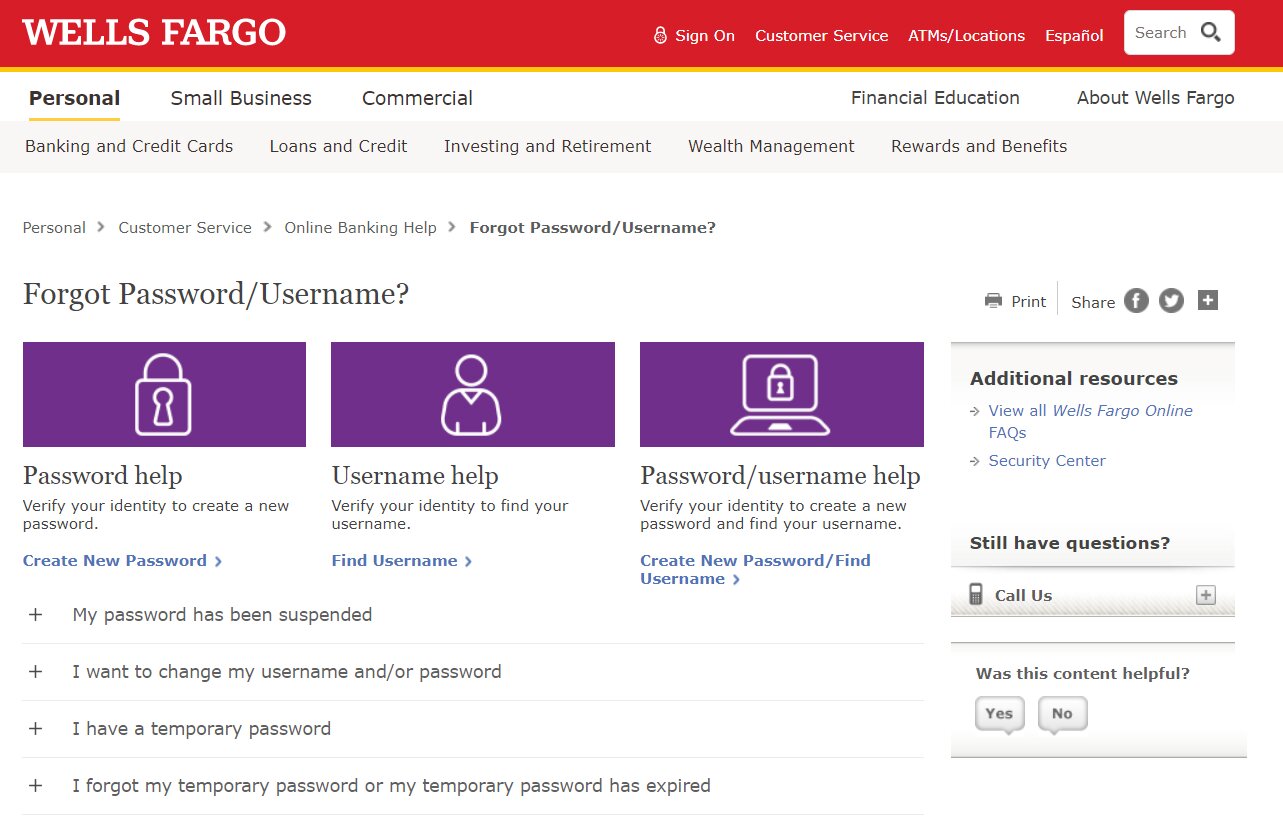

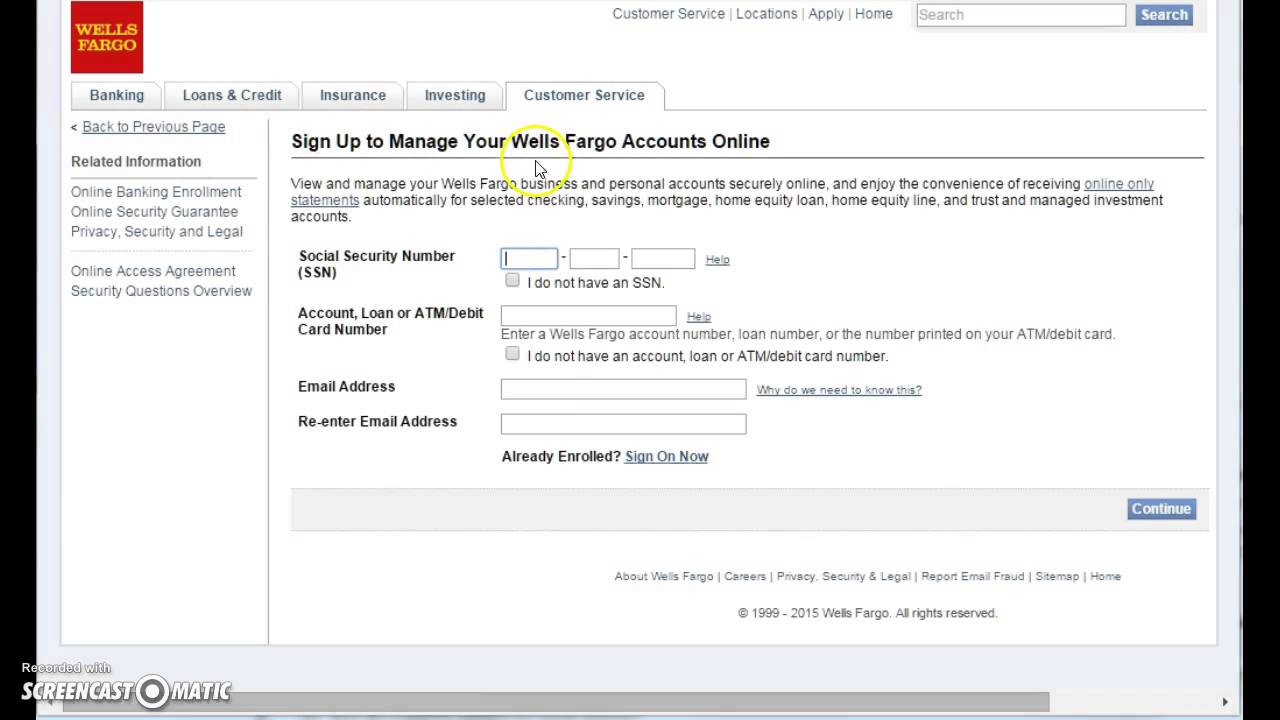

For instance, neither Chase nor Bank of America —Wells Fargo's two closest competitors —carry any options specifically marketed to customers whose credit or banking histories prevent them from getting approved for accounts elsewhere. The Wells Fargo Opportunity Checking Account gives such "toxic" bank customers an opportunity to get back into the mainstream banking system. WellsFargoLoginHow to login to your wellsfargo bank online banking in 2020This video tutorial explains the process involved in wells fargo bank online bank.

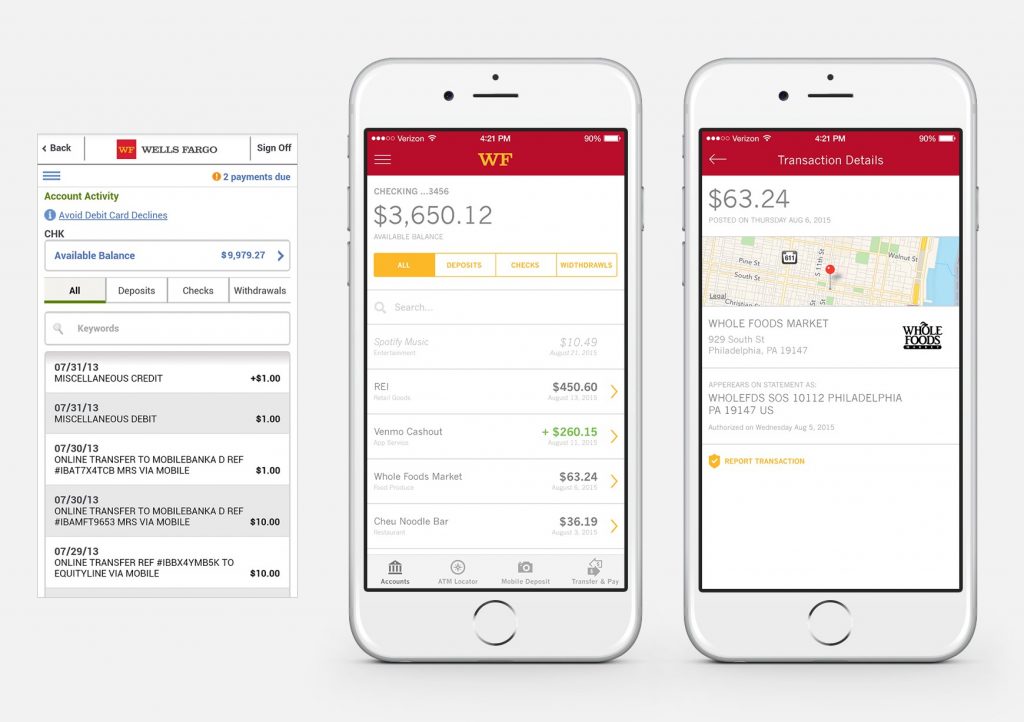

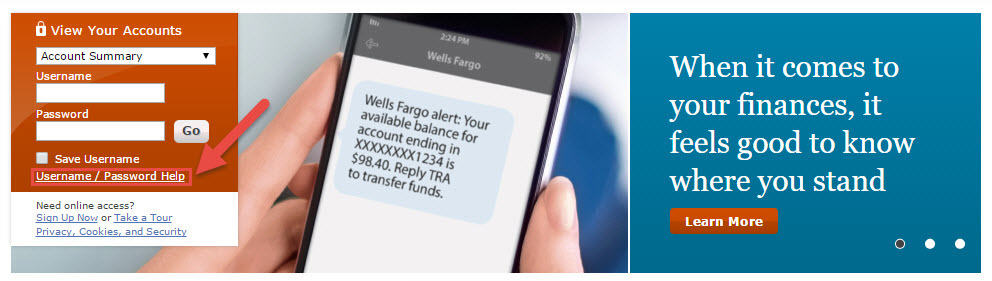

With online banking through Wells Fargo Online you can monitor your balances and activity set up alerts and view statements all from your smartphone tablet or desktop. Make sure that any outstanding checks have been paid andor you have made different. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services LLC WFCS and Wells Fargo Advisors Financial Network LLC Members SIPC separate registered broker-dealers and non-bank affiliates of Wells Fargo Company. Canada Users Sign On Here Utilisateurs Canadiens Veuillez ouvrir une session ici.

Charges may apply however for the Wells Fargo Same Day Payments Service SM. Wells Fargo business services and login. Bank online Find routing or account number Products and services. Designed for everyday spenders, Wells Fargo will begin taking applications for the Reflect card on October 1. As with each of the cards in the new Visa portfolio announced in June, Reflect offers a unique yet straightforward feature that rewards customers for making on-time payments — a habit that can help build credit over time. This segment services business clients and high-net-worth individuals by offering them wealth management services, as well as investment and retirement products. Some of these services include financial planning, credit, and private banking.

Wells Fargo offers the standard customer service benefits you'd expect with a bank of this size. That includes the option to manage your account over the phone, online, via mobile banking, at an ATM, or a branch location. It also offers the option to live chat with customer service agents. Though it's a savings account, you have the ability to write checks from this account as long as you have the sufficient funds in the account.

You can also link this account to a regular Wells Fargo checking account for overdraft protection. You can make automatic deposits to this account through Save As You Go transfers. The program transfers $1 from your checking to savings account whenever you make non-recurring debit purchases and any online bill payment transactions. Not only does the bank's mobile app earn solid praise from reviewers, but the big bank continues to push ahead on rolling out features faster than its peers. For example, many banks let you turn your debit card on and off from a mobile app. But the Wells Fargo app goes further by also letting you track where you've shared your payment information to get services like Amazon Prime.

Location aside, Chase tends to fall behind Wells Fargo in the variety of checking and savings services it offers. "We apologize to our customers who may be experiencing an issue with our online banking and mobile app," Wells Fargo tweeted. "Thanks for your patience while we research this issue. If you are impacted, please check back here for updates."

Wells Fargo is an excellent bank for those looking for both local branch access and digital banking services. The bank's interest rates on most of its accounts leave a lot to be desired compared to the best online banks, but they are comparable to other national banks. Wells Fargo is one of the oldest financial institutions in the United States. Founded in 1852, Wells Fargo has grown to become one of the largest national banks in America. Wells Fargo maintains a vast physical presence with more than 5,200 bank branches and over 13,000 ATMs spread across the U.S. The national bank is home to several checking and savings products and many other banking solutions for individuals, businesses and corporations.

Wells Fargo offers great credit card benefits that make their cards worth considering. Take a look at all the unique benefits Wells Fargo offers. Just because Wells Fargo is a big, national bank, doesn't mean they don't offer unique benefits to their credit card holders. Along with a competitive, variable rate and no monthly maintenance fees, this account comes with tools to grow your money faster. Like most savings accounts, there's a limit of 6 withdrawals per statement cycle, but using our tools won't count toward those limits.

Retail banking consists of basic financial services, such as checking and savings accounts, sold to the general public via local branches. Everyday Checking is Wells Fargo Bank's most popular checking account option. This checking account may be ideal for students since the $10 monthly service fee is waived for college students when the primary account owner is 17 to 24 years old. Have access to checking, savings, credit card, mortgage, investments, and other loan accounts all in one place.

Like Wells Fargo, Capital One places a good deal of focus on small business accounts. The Capital One Spark Business Basic Checking and Spark Unlimited Checking Accounts come with unlimited free transactions, meaning businesses won't have to deal with a per-item fee every time their customers make a payment into the account. Most banks, including Wells Fargo, limit a business's free transactions to about 500 per month or fewer. However, Chase does have a better set of credit card options, all of which earn points within the Ultimate Rewards program. This means that frequent credit card users may find better value banking with Chase, since they'll be able to link their bank balances to pay off Chase cards automatically.

Wells Fargo customers were unable to use debit cards or access online banking because of a "systems issue" causing "intermittent outages," the company said on Twitter on Thursday morning. Wells Fargo customers on Thursday were unable to use their debit cards or access online banking because of a "systems issue" that caused intermittent outages, the company said. Wells Fargo offers several investment services, including self-directed and automated investing. Wells Fargo provides IRAs, mutual funds, rollover accounts and college savings accounts for retirement and education planning. "We know the importance of the stimulus funds to our customers, and Wells Fargo is making the stimulus funds available immediately when they are made available to us," Wells Fargo said in a statement on Tuesday. The outage Wednesday morning occurred on the first official payment date for customers to receive the third round of stimulus checks from the American Rescue Plan.

While the federal government announced last week that it had started processing and distributing the first wave of payments, several banks, including Wells Fargo, had told customers the money wouldn't be available until Wednesday. On 18 May 1995, Wells Fargo became the first bank in the US to give customers free Internet access to current balances in their checking, savings, line of credit and credit card accounts. Wells Fargo's digital team wasn't content with having made history developing a new way to bank. It wanted to create a place where customers could manage all aspects of their financial lives.

Some ideas, like offering horoscopes and used car sales alongside account histories ended quickly with little enthusiasm. Others, like merging all online accounts into one portal with one log in and mobile banking created meaningful improvements to people's lives. Flexible spending accounts and health reimbursement accounts are administered by OptumHealth Financial Services and are subject to eligibility and restrictions. The content on this website is not intended as legal or tax advice.

Federal and state laws and regulations are subject to change. 4Touch ID is available only for newer iPhone models using iOS 8 or higher. Use of your Mobile device requires enrollment in Online Banking and download of our Mobile App. Wireless carriers may charge fees for text transmissions or data usage. Mobile Banking requires an internet-ready phone and is supported on Apple iPhone devices with iOS 9 and greater and on Android mobile devices with OS 5 and greater.

Mobile deposits made before 7 pm PT will be processed the same business day and made available within two business days. Longer delays may apply based on the type of items deposited, amount of the deposit, account history or if you have recently opened your account with us. We round up transactions like debit or credit card purchases, electronic payments, and checks written from tracked account. Federal law permits limiting certain types of withdrawals and transfers from savings accounts to a combined total of 6 per statement cycle. These limited transactions include things like Online and Mobile Banking transfers, transfers from your account to any of your accounts with us, or to a third party.

Times reported that desperate branch employees opened fake accounts and credit cards in order to meet their sales quotas. At the time of the story, the bank denied all the claims. It was only three years later in 2016 that the company admitted that over 3.5 million unwanted accounts were opened. You'll need to keep at least a $3,500 minimum daily balance to avoid the $12 monthly service fee.

On October 12, 2016, John Stumpf, the then chairman and CEO, announced that he would be retiring amidst the scandals. President and Chief Operating Officer Timothy J. Sloan succeeded Stumpf, effective immediately. Following the scandal, applications for credit cards and checking accounts at the bank plummeted. In response to the event, the Better Business Bureau dropped accreditation of the bank.

Several states and cities ended business relations with the company. Elizabeth Magner, a federal bankruptcy judge in the Eastern District of Louisiana, cited the bank's behavior as "highly reprehensible", stating that Wells Fargo has taken advantage of borrowers who rely on the bank's accurate calculations. Wells Fargo is working to fix a widespread outage preventing some customers from using the mobile app and accessing their online banking accounts.

Wells Fargo Bank employs several security measures to protect its customers and their funds. Some of its security measures include the latest encryption technology, advanced sign-in options, automatic sign-offs, zero liability protection on debit and credit cards and fraud monitoring. All of Wells Fargo's bank accounts come with monthly service fees. You may be better off banking elsewhere if you aren't confident you can meet monthly requirements to have the fees waived.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.